This article has been updated for 2026 with new and updated date: EV Ownership in 2026: Ranking All 50 States + DC

Vermont beats California. Wyoming outpaces New York. North Dakota ranks higher than Texas. In the geography of electric car ownership, nothing is quite as it seems.

With 3.57 million electric vehicles now registered across America, choosing where to live has become one of the most important decisions for prospective EV owners. A state-by-state examination of charging infrastructure, electricity costs, government incentives, and market conditions reveals stark differences that can make or break the electric car experience.

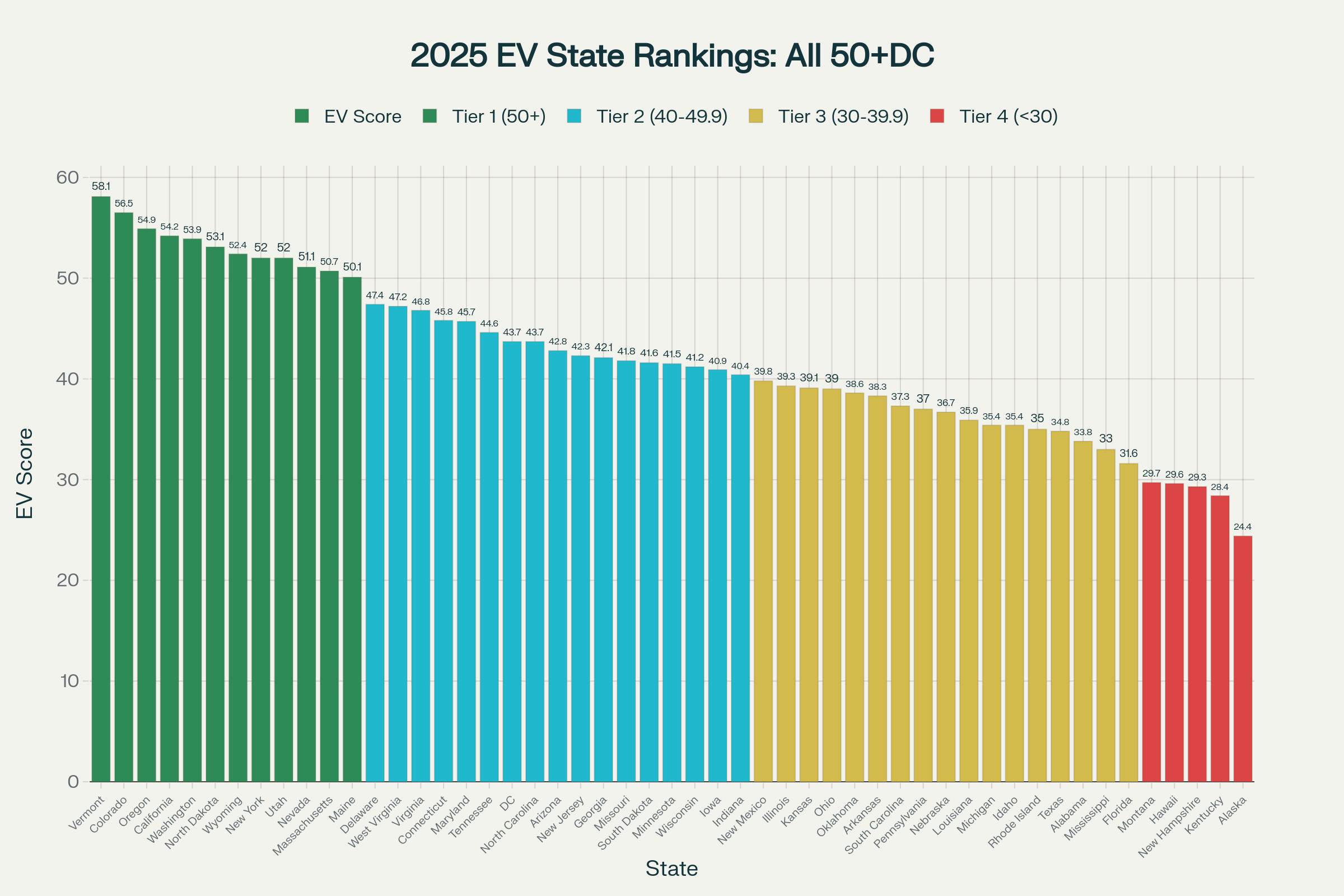

The Complete Rankings: Four Performance Tiers

America’s EV landscape divides into four distinct performance categories, with 12 states achieving excellent conditions, 17 providing good support, 17 offering fair conditions, and 5 struggling with significant challenges.

Tier 1: The EV Excellence Leaders (Score 50+)

Twelve states have achieved excellent EV conditions, creating support systems that make electric vehicle ownership attractive through strong infrastructure, reasonable costs, and supportive policies.

Vermont Claims the Crown (58.1 Score)

Vermont’s rise to the top demonstrates how smaller states can excel through focused policy initiatives. The Green Mountain State outperforms traditional leaders through smart planning rather than scale:

- EV Market Share: 3.15% of all registered vehicles

- State Incentives: Up to $7,500 in rebates through Drive Electric Vermont

- Charging Infrastructure: 66.9 ports per 1,000 EVs

- Electricity Costs: 23.2¢ per kWh

- Total Registered EVs: 17,939

The Western Powerhouses

Four western states dominate the top tier with mature EV ecosystems:

- Colorado (56.5 Score): Combines moderate electricity rates (16.2¢/kWh) with $7,500 incentives and 18 operational NEVI stations

- Oregon (54.9 Score): Leads NEVI deployment with 22 operational sites and comprehensive Clean Vehicle Rebate Program

- California (54.2 Score): Maintains 1.26 million registered EVs and offers up to $14,000 in combined incentives despite infrastructure strain

- Washington (53.9 Score): Balances 2.67% market share with low electricity costs (13.0¢/kWh) and $4,000 rebates

The Infrastructure Pioneers

Two rural states achieve top-tier status despite minimal EV adoption through exceptional infrastructure preparation:

- North Dakota (53.1 Score): Leads nationally with 333.7 charging ports per 1,000 EVs

- Wyoming (52.4 Score): Second-best infrastructure density at 333.6 ports per 1,000 EVs

- Both states position themselves as EV corridor leaders with strategic federal funding deployment

Northeast Excellence

Three northeastern states complete Tier 1 through strong incentive programs and dense infrastructure networks:

- New York (52.0 Score): Offers $7,500 rebates with 175.2 ports per 1,000 EVs

- Massachusetts (50.7 Score): Maintains 169.5 ports per 1,000 EVs despite 30.4¢/kWh electricity

- Maine (50.1 Score): Achieves 189.8 ports per 1,000 EVs with $7,500 maximum rebates

Tier 2: The Solid Performers (Score 40-49.9)

Seventeen states provide good EV conditions with moderate support across key categories:

Regional Standouts Include:

- Delaware (47.4): Highest EV market share in this tier at 2.41%

- Virginia (46.8): Balanced infrastructure (70.6 ports/1,000 EVs) and moderate costs

- Connecticut (45.8): Dense infrastructure (126.8 ports/1,000 EVs) with $7,500 incentives

- North Carolina (43.7): Low electricity costs (13.3¢/kWh) with $5,000 incentives

- Arizona (42.8): Growing 1.61% market share with substantial infrastructure development

Midwest Representation:

The region shows strength in this tier with six states achieving good conditions through balanced approaches:

- Missouri, South Dakota, Minnesota, Wisconsin, Iowa, and Indiana all score 40+ points

Tier 3: The Fair Conditions States (Score 30-39.9)

Seventeen states offer fair EV conditions, typically challenged by limited incentives, higher costs, or infrastructure gaps:

Notable Fair Tier States:

- Texas (34.8): Despite 230,125 registered EVs and 32 NEVI stations, limited state incentives hurt ranking

- Illinois (39.3): Large EV population faces infrastructure density challenges

- Pennsylvania (37.0): Moderate conditions across categories without standout strengths

- Florida (31.6): High registration numbers (254,878) but zero state incentives

Tier 4: The Challenging Markets (Score Below 30)

Five states face significant EV adoption challenges through combinations of high costs, limited infrastructure, or minimal policy support.

The Bottom Five:

- Alaska (24.4): Extreme electricity costs (26.9¢/kWh), minimal incentives ($500)

- Kentucky (28.4): No state incentives and limited infrastructure development

- New Hampshire (29.3): High electricity costs (23.5¢/kWh) with minimal incentives

- Hawaii (29.6): Highest electricity costs nationwide (41.0¢/kWh) despite 2.85% market share

- Montana (29.7): No state incentives and sparse population density

Regional Performance Patterns

The West Leads Innovation (Average Score: 44.4)

Western states capture 7 of the top 15 positions, led by Colorado’s second-place ranking:

Western Achievements:

- Seven states in Tier 1 (excellent conditions)

- Strong NEVI deployment with 153 total stations across the region

- Average market share of 1.48% with California driving volume

- Benefits from environmental consciousness and renewable energy abundance

The Northeast Compensates for High Costs (Average Score: 44.5)

Despite high electricity rates, the Northeast achieves the highest regional average through superior infrastructure density and strong incentives:

Northeast Strengths:

- Vermont leads the nation at number one overall

- Four states in Tier 1, including Massachusetts and Maine

- Average maximum incentive of $4,944, highest among regions

- Compact geography enables efficient charging networks

The Midwest Balances Costs and Infrastructure (Average Score: 40.8)

Midwestern states excel in electricity affordability while building substantial infrastructure foundations:

Midwest Characteristics:

- North Dakota ranks 6th nationally with exceptional infrastructure

- Consistently low electricity rates across the region

- Growing NEVI deployment along major interstate corridors

- Balanced approach to incentives and infrastructure development

The South Faces Mixed Conditions (Average Score: 39.6)

Southern states show the widest performance variation, from Delaware’s excellence to Kentucky’s challenges:

Southern Regional Patterns:

- Delaware leads the region at 13th nationally

- Texas shows potential with high volumes but limited state support

- Florida demonstrates demand (254,878 EVs) without policy backing

- Significant federal NEVI investment beginning to address rural gaps

Category Leaders: Excellence by Numbers

EV Market Share Champions

Leading states prove that market penetration results from policy approaches rather than single factors:

- California: 4.28% market share with 1.26 million EVs

- Vermont: 3.15% through targeted incentives and infrastructure

- DC: 2.89% via urban density and policy support

- Hawaii: 2.85% despite highest electricity costs nationwide

- Washington: 2.67% with balanced cost and policy approach

Infrastructure Density Leaders

Rural states lead charging infrastructure preparation, positioning for future growth:

- North Dakota: 333.7 ports per 1,000 EVs

- Wyoming: 333.6 ports per 1,000 EVs

- West Virginia: 235.7 ports per 1,000 EVs

- Maine: 189.8 ports per 1,000 EVs

- New York: 175.2 ports per 1,000 EVs

Electricity Cost Advantages

Low-cost electricity creates compelling EV economics in specific markets:

- Nevada: 11.4¢ per kWh

- Idaho: 12.1¢ per kWh

- Louisiana: 12.6¢ per kWh

- Washington: 13.0¢ per kWh

- Utah: 13.1¢ per kWh

State Incentive Program Leaders

Maximum state incentive programs significantly impact EV economics:

Top Incentive Programs:

- California: Up to $14,000 through multiple programs

- Eight States at $7,500: Vermont, Colorado, Oregon, New York, Massachusetts, Maine, Connecticut, New Jersey

- Five States at $5,000: Delaware, Maryland, Georgia, Hawaii, North Carolina, Arizona

States with Zero Incentives: Kentucky, Montana, North Dakota, Wyoming, Florida offer no state support

Federal Infrastructure Impact: The NEVI Program

The National Electric Vehicle Infrastructure program has deployed 481 charging stations nationwide, transforming long-distance EV travel:

NEVI Deployment Leaders:

- California: 45 stations (supporting highest EV volume)

- Texas: 32 stations (covering vast geography)

- Florida: 28 stations (connecting urban centers)

- Washington: 25 stations (enabling regional travel)

- Oregon: 22 stations (completing West Coast corridor)

Rural Success Stories:

Rural states achieve exceptional infrastructure ratios despite lower absolute numbers:

- Wyoming: 8 stations serving 1,139 EVs

- North Dakota: 5 stations serving 959 EVs

- Both positioned for future growth through strategic corridor planning

Market Economics: The Cost Reality

Electricity Rate Impacts

State electricity costs vary dramatically, directly affecting EV operating expenses:

Most Affordable Markets:

- Nevada drivers pay 11.4¢/kWh

- Hawaii residents face 41.0¢/kWh

- Cost difference: 259% more expensive in Hawaii

- Annual impact: $295 additional cost for typical driver charging 1,000 kWh

Regional Cost Patterns:

- Western states generally offer moderate rates

- Northeastern states face premium pricing

- Southern states show mixed pricing

- Midwestern states provide consistently low costs

Incentive Program Variations

State support varies from generous to nonexistent:

Comprehensive Support States:

- California leads with up to $14,000 in combined programs

- Nine states offer $5,000+ maximum rebates

- Programs target income-qualified residents with enhanced benefits

Limited or No Support States:

- Five states offer zero state incentives

- Buyers in these markets rely entirely on federal tax credits

- Creates significant economic disparities between neighboring states

Planning Your EV Purchase: Practical Implications

For Prospective Buyers

Location determines EV financial viability:

Best Purchase Locations:

- Tier 1 States: Comprehensive support with strong incentives and infrastructure

- Vermont Example: $7,500 rebate plus excellent charging network

- Colorado Example: Balanced costs with substantial state support

Challenging Purchase Markets:

- Tier 4 States: Minimal support with high costs or limited infrastructure

- Kentucky Example: No incentives, limited charging options

- Hawaii Example: Strong adoption despite crushing electricity costs

For Long-Distance Travel

Cross-state trips require strategic planning based on infrastructure availability:

Well-Served Corridors:

- West Coast: California to Washington fully supported

- Northeast: Vermont to DC with dense charging networks

- Interstate Routes: Major highways increasingly NEVI-equipped

Challenging Routes:

- Rural Mountain West: Gaps between charging stations

- Southern Rural Areas: Limited infrastructure outside major cities

- Cross-Country Travel: Requires careful route planning

For State Policymakers

Data reveals clear improvement strategies:

Infrastructure-First States (like Wyoming, North Dakota):

- Build charging networks ahead of demand

- Position for future adoption growth

- Attract EV tourism and corridor traffic

Incentive-Rich States (like New Jersey):

- Strong purchase support but infrastructure gaps

- Need charging investment to match policy ambition

- Focus on urban and workplace charging expansion

Market Evolution

Infrastructure Development Priorities

Current deployment patterns suggest strategic focus areas:

High-Priority Development Regions:

- Southern corridor completion connecting Texas to Florida

- Mountain West connections through Montana, Wyoming, Idaho

- Midwest hub development in Illinois, Ohio, Michigan

- Rural accessibility improvements nationwide

Policy Evolution Trends

Successful states demonstrate replicable approaches:

Proven Policy Strategies:

- Income-qualified enhanced incentives (California model)

- Used EV rebate programs (Vermont approach)

- Utility partnership programs (multiple states)

- Multi-family housing charging requirements (urban focus)

Market Maturation Indicators

Leading states show characteristics of mature EV markets:

Maturity Markers:

- Market share exceeding 2%

- Infrastructure density above 100 ports per 1,000 EVs

- Comprehensive policy ecosystems

- Regional travel corridor completion

State-by-State Quick Reference Guide

Choose These States for EV Excellence

Top Recommended Markets:

- Vermont: Best overall conditions with comprehensive support system

- Colorado: Mountain West leader with balanced approach to all factors

- Oregon: Pacific Northwest excellence with NEVI leadership

- California: Volume leader despite infrastructure challenges

- Washington: Cost-effective Pacific Northwest option with low electricity rates

Consider These Emerging Markets

Growth Potential States:

- North Dakota/Wyoming: Infrastructure leaders preparing for growth

- Utah/Nevada: Western growth markets with good fundamentals

- Delaware/Virginia: East Coast balance of cost and support

- North Carolina: Southern leader with reasonable economics

Proceed with Caution in These Markets

Challenging EV Markets:

- Alaska: Extreme costs and climate challenges

- Kentucky: Limited policy support and infrastructure gaps

- Hawaii: Highest electricity costs despite strong adoption rates

- New Hampshire: High costs without offsetting benefits

The Bottom Line

The 2025 state-by-state analysis reveals that EV ownership success continues varying dramatically by location. While federal NEVI infrastructure investment begins leveling the playing field, state policies remain the primary factor distinguishing excellent from poor EV conditions.

Prospective buyers should prioritize states with comprehensive approaches (Tier 1), consider emerging markets with strong fundamentals (Tier 2), carefully evaluate limited-support regions (Tier 3), and exercise caution in challenging markets (Tier 4).

Electric vehicle adoption accelerates nationwide, but owner success depends heavily on location choice. With 481 NEVI stations operational and growing state policy support, the American EV landscape continues improving. However, significant geographic disparities persist that smart buyers must carefully consider when making purchase decisions.

Your success as an EV owner depends on where you plug in. Choose wisely.

Sources:

- https://afdc.energy.gov/data/10962

- https://www.eia.gov/electricity/state/

- https://www.fhwa.dot.gov/policyinformation/statistics/2023/mv1.cfm

Article Last Updated: January 16, 2026.